“Every person who invests in well-selected real estate in a growing section of a prosperous community adopts the surest and safest method of becoming independent, for real estate is the basis of wealth.”

Theodore Roosevelt, U.S. President.

“Don’t put all your eggs in one basket.” This age-old wisdom holds true for investing, where diversification is key to a robust portfolio. This blog explores how fractional real estate investing can help diversify and stabilize your investments, providing a balanced approach to wealth management.

Introduction to Investment Diversification

Diversification involves spreading investments across various asset classes to reduce risk. Real estate, particularly fractional ownership, is crucial in achieving this balance. The only certainty is uncertainty, emphasizing the need for a diversified portfolio management in the face of market fluctuations. Don’t wait to invest in real estate. Make the purchase and wait.

The Role of Real Estate in Diversification

Real estate is a tangible asset that can provide steady income and appreciation. You can hedge against market volatility and inflation by including real estate in your portfolio. Partnering with a fractional real estate platform like Fracty will help you hold a diversified investment portfolio in real estate across locations, markets, and domains.

Benefits of Fractional Real Estate Investing

Fractional real estate investment allows you to own percentages of different types of properties, giving you the following advantages.

- Access to High-Value Properties: Invest in prime real estate without the need for significant capital.

- Liquidity: Buy and sell with ease, providing flexibility.

- Reduced Risk: Share the financial burden and risk with other investors.

- Passive Income: Earn rental income and potential property appreciation.

Importance of Diversifying Your Investment Portfolio

Investing in a variety of assets mitigates risk and enhances potential returns. Fractional real estate allows you to diversify your investments without the significant capital outlay required for full property ownership, restricted to one class of assets. This approach not only spreads risk but also opens up opportunities in high-value markets previously inaccessible to individual investors.

How to Incorporate Fractional Real Estate into Your Portfolio

- Assess Your Goals: Determine your investment objectives and risk tolerance.

- Research Opportunities: Identify suitable fractional ownership platforms and properties.

- Allocate Funds: Decide how much to invest in fractional real estate.

- Monitor Performance: Regularly review your investments and make adjustments as needed.

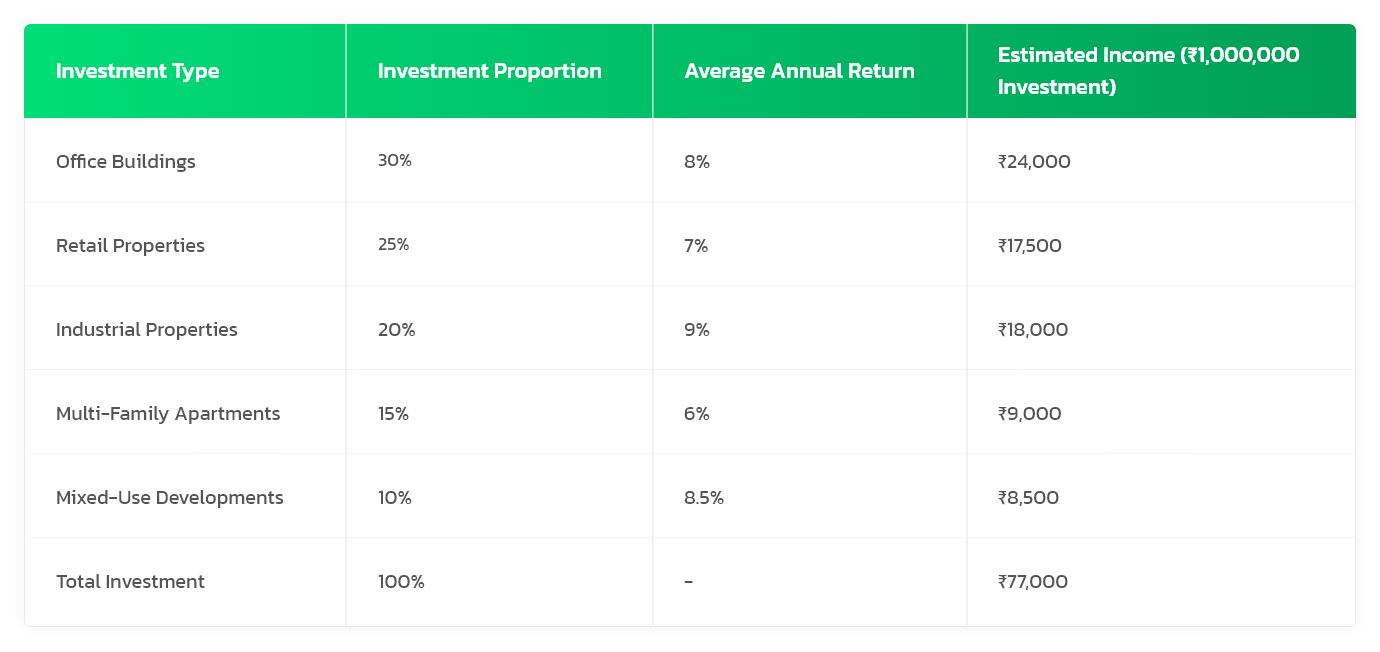

Here’s a table that explains the diversification of commercial real estate investment and provides an estimate of income with different proportions allocated to each type of commercial real estate:

Explanation:

- Office Buildings (30%): A substantial portion of the investment is allocated to office buildings, which typically offer a stable return of around 8% annually. This results in an estimated income of ₹24,000 from a ₹300,000 allocation.

- Retail Properties (25%): Retail properties are slightly riskier but still offer a good return of about 7%. With a ₹250,000 investment, the estimated income is ₹17,500.

- Industrial Properties (20%): These properties are highly sought after for their strong returns and relatively low risk, offering an average return of 9%. A ₹200,000 investment can yield an estimated income of ₹18,000.

- Multi-Family Apartments (15%): Multi-family residential properties are a stable investment, providing a lower return of around 6%. A ₹150,000 investment results in an estimated income of ₹9,000.

- Mixed-Use Developments (10%): Mixed-use developments combine residential, commercial, and sometimes industrial spaces, offering a balanced return of 8.5%. A ₹100,000 investment can generate an estimated income of ₹8,500.

Total Income:

- Estimated Total Income: When the total investment of ₹1,000,000 is diversified across these commercial real estate types, the estimated total income is ₹77,000 annually.

This diversification strategy spreads the investment across different types of commercial properties, balancing risk and return to achieve a stable and potentially lucrative portfolio.

Please note that the numbers are purely illustrative. Do understand the current market conditions and economic cycles before you begin your investment journey.

Essential Tips for First-Time Real Estate Investors

As a first-time real estate investor, you will have a few doubts about how to begin. Here are a few tips that will help you.

Start with a Small, Diversified Investment:

Begin your journey with a modest stake in a single property. Alternatively, opt for platforms that offer a pre-diversified portfolio to spread your risk right from the start.

Opt for SEBI-Registered Platforms:

Ensure your chosen platform is registered with the Securities and Exchange Board of India (SEBI) to benefit from regulatory oversight and investor protection.

Prioritize Comprehensive Due Diligence:

Analyze the platform’s fee structure, historical performance, and reputation. Independently assess the property’s location, rental prospects, and future appreciation potential to make well-informed decisions.

Understand Your Exit Strategies:

Gain a clear understanding of the processes and timelines for selling your shares or exiting the investment. This knowledge will help you avoid potential liquidity issues and plan effectively.

Calculate your Potential Revenue

Use ROI calculators and consult your financial advisor to determine projected returns and risk tolerance. Gain valuable insights and set realistic expectations.

Stay Updated on Market Trends:

Stay aware of the latest trends in the real estate market. Understanding market dynamics will help you make timely and profitable investment choices.

Diversify with New Developments and Existing Properties

Analyze the pros and cons of investing in a fraction of new and existing properties. New developments bring you low entry points with pre-launch pricing strategies while existing properties provide a more predictable scenario.

Plan for Long-Term Growth:

Adopt a long-term perspective for your fractional real estate investments. While quick gains may be tempting, allowing your investment to mature over time can yield substantial benefits from rental income and property appreciation.

Building Wealth with Diversification

Fractional real estate investing offers a practical way to diversify your portfolio, combining the benefits of real estate with the flexibility and lower costs of fractional ownership. By incorporating this asset class, you can achieve a more balanced and resilient investment strategy. “Diversification is the only free lunch in finance,” said Nobel laureate Harry Markowitz, reminding us that spreading our investments is a smart way to manage risk and secure long-term financial stability.

Connect with us for more information on diversified portfolio management.